Rare earth magnets—small yet immensely powerful—are the unsung heroes behind much of today’s technological advancements. From electric vehicles (EVs) and wind turbines to smartphones and defense systems, these magnets are integral to modern life. However, recent geopolitical developments have thrust them into the spotlight, particularly due to China’s dominant position in their production and export.1

Understanding Rare Earth Magnets

Rare earth magnets are permanent magnets made from alloys of rare earth elements. They are the strongest type of permanent magnets available, producing significantly stronger magnetic fields than other types such as ferrite or alnico magnets.

There are two primary types:

- Neodymium magnets (NdFeB): Composed of neodymium, iron, and boron, these are the most widely used rare earth magnets due to their exceptional strength and affordability.

- Samarium-cobalt magnets (SmCo): Known for their high-temperature stability and resistance to corrosion, making them suitable for specialized applications.

These magnets are pivotal in various applications:

- Electric Vehicles (EVs): Powering motors in EVs, contributing to energy efficiency and performance.

- Wind Turbines: Enhancing the efficiency of generators in renewable energy setups.

- Consumer Electronics: Used in headphones, hard drives, and smartphones.2

- Medical Devices: Integral to MRI machines and other diagnostic equipment.

- DefenceChina’s Dominance in the Rare Earth Magnet Industry

- Systems: Essential in precision-guided munitions, radar systems, and other military technologies.

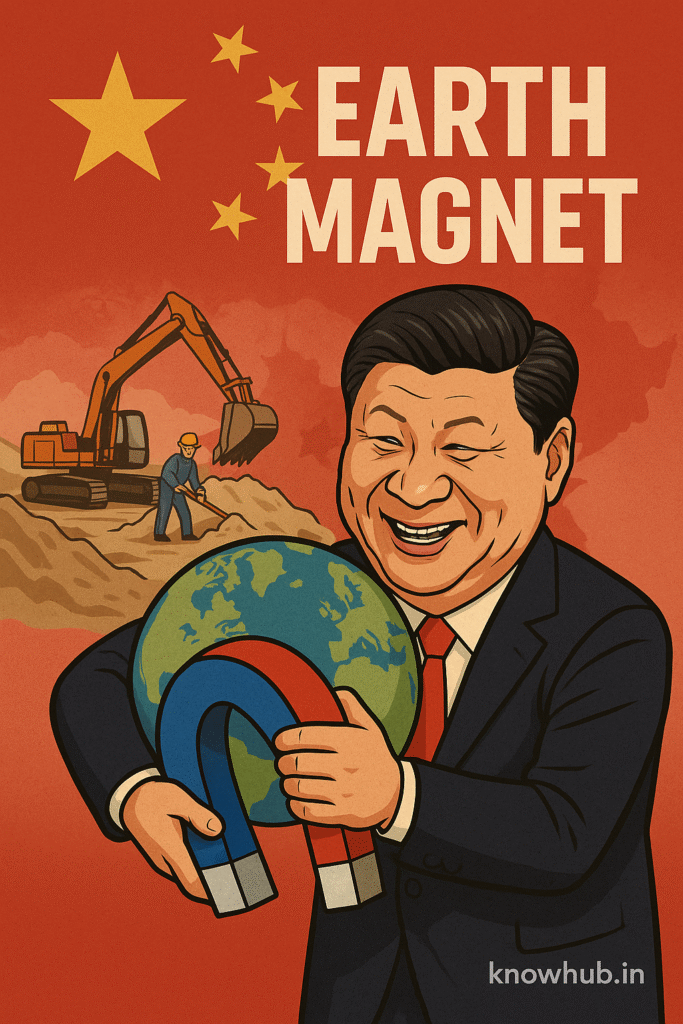

China’s Dominance in the Rare Earth Magnet Industry

China has established a near-monopoly in the rare earth magnet sector, accounting for over 90% of global production. This dominance is a result of strategic investments, favorable policies, and control over critical mining and processing infrastructure. Key factors contributing to China’s position includ:

- Resource Abundance: Significant reserves of rare earth elements, particularly in Inner Mongolia.

- Integrated Supply Chain: Comprehensive control from mining to final magnet production.

- Government Support: Policies and subsidies that have bolstered the rare earth industry.

Companies like Shenghe Resources, partly state-owned, play a pivotal role in this ecosystem, with investments extending to international projects to secure supply chains.

Recent Developments: China’s Export Controls

In April 2025, China introduced stringent export controls on several rare earth elements and associated magnets, citing national security concerns. This move requires exporters to obtain licenses, with detailed reporting on trading volumes and client information. The implications have been significant

Market Volatility: Uncertainty has led to fluctuations in related markets, impacting investor confidence.

Global Supply Chain Disruptions: Industries reliant on these materials, including automotive and electronics, face potential shortages and increased costs.

Geopolitical Tensions: The United States and other nations view these controls as leverage in broader trade disputes.

Impact of this dominance on India:

- India’s EV ambitions are directly tied to the availability of neodymium magnets, which are currently sourced largely from China.

- The cost of electric motors in India is rising as rare earth magnet prices surge due to China’s export restrictions.

- India imports over 90% of its rare earth magnet components, making its EV ecosystem highly vulnerable to Chinese supply disruptions.

- EV manufacturers like Tata Motors and Mahindra are exploring partnerships with local startups to indigenize magnet production.

- China’s grip on rare earths poses a threat to India’s goal of achieving 30% EV penetration by 2030.

- Startups in India are beginning R&D into magnet-free motor designs, but these are still years away from commercial use.

- Global supply shortages have slowed the rollout of affordable electric two-wheelers and e-rickshaws across rural India.

- India’s Ministry of Mines is working with the Indian Rare Earths Ltd (IREL) to accelerate local mining and refining projects.

- Policy reforms under the “Critical Mineral Mission” are expected to boost India’s domestic rare earth capabilities, reducing dependency.

- Without localized rare earth magnet production, India risks falling behind in the global EV race and green energy transition.

The Road Ahead

The rare earth magnet sector stands at the intersection of technological advancement and geopolitical strategy. As nations grapple with the challenges posed by supply chain dependencies, the push for diversification and innovation becomes paramount. For businesses and policymakers alike, understanding the dynamics of this critical industry is essential for navigating the complexities of the modern global economy.

For more in-depth analyses and updates on critical minerals and global trade dynamics, visit KnowHub.in.

Want to learn Science? See our courses